Financial Simulation Course for Talents from SME

制造企业管理人员财务模拟实战课程

Course Background | 课程背景

The Corporate Financial Management Simulation Course aims to illustrate the principles of raising, allocating, and converting business resources through simulated corporate operations. It introduces financial concepts and related knowledge, explores the origins of corporate value creation, implements comprehensive cost control, strengthens cash flow awareness, enhances capital operation efficiency, teaches financial terminology, and demonstrates how financial tools can improve profitability. This course elevates participants' strategic execution capabilities within enterprises.

企业财务管理模拟实战课程旨在通过模拟企业的各项经营活动,形象演绎企业 商业资源的筹集、分配、转化原则,引入财务概念和相关知识, 探索企业价值产生的根源, 尝试进行全面成本控制,强化现金流意识,提高资金运作效率,掌握企业财务语言,学习利 用财务手段改进企业盈利水平,提升学员对企业的战略执行能力。

Course Features | 课程特色

• The interactive, real-world simulation format fosters high learner engagement and strong practical applicability. | 实战模拟形式互动性强,学员学习热情高,实用性强。

• Instructors deliver concise, easy-to-understand explanations that blend theory with hands-on practice, offering powerful insights. | 导师讲解精辟,容易理解,理论与实操相结合,启发性强

Who Should Attend | 谁应该参加

Account Manager, Project Manager, Product Manager, Sales, R&D, Production, Supply Chain | 客户经理,项目经理,产品经理、业务人员、 研发人员、供应链人员

Objectives and Benefits | 课程目标和学员收益

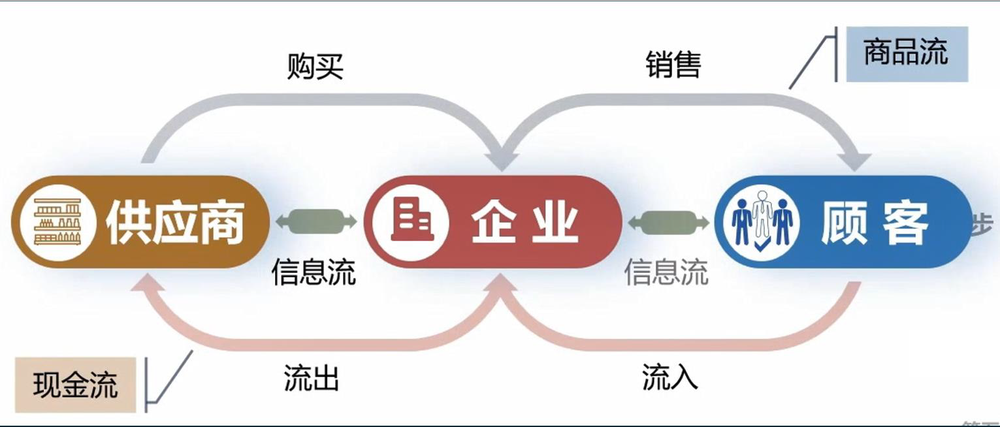

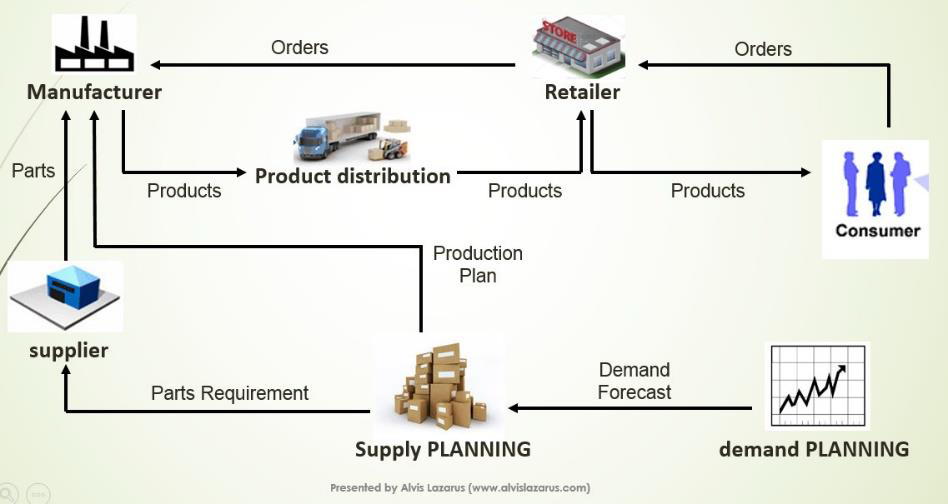

• Grasp key elements of business operations and leverage them to align operations and drive profitability | 理解商业活动的关键元素,利用这些元素使公司协调运作并赢利

• Define work objectives and communicate effectively across departments to achieve operational efficiency | 决定工作目标,如何与其他部门有效的沟通以达到高效的运作

• Measure company profitability and cash flow using financial data | 如何通过财务数据来衡量公司盈利和现金流

• Decode the stories behind financial statement figures to analyze and leverage critical insights | 解读财务报表数字背后的故事,分析和利用有关信息

• Develop holistic thinking to create sustainable value for the organization | 培养全局观念,为公司持续创造价值课程对象

Course Format | 课程形式

• Enterprise Operation Business Simulation | 企业经营沙盘模拟

• Key Concepts Lecture | 课堂内容精华讲授

• Case Analysis & Group Discussion | 案例分析小组讨论

• Instructor's Feedback on Performance | 学员表现导师点评

Language | 语言

Chinese | 中文

Training Outline | 课程大纲

I. How Managers Should Understand and Master Financial Statements | 经理人应当如何理解和掌握财务报表

* Balance Sheet | 资产负债表

• By conducting physical inventory counts at period-end for simulated companies, prepare the balance sheet hands-on. Understand its structure, components, meaning, and the characteristics of assets, liabilities, and owner's equity. | 通过各期末盘点模拟企业的资产状况,亲手制作资产负债表,了解资产负债表的结构、项目、含义以及资产、负债、所有者权益的特点。

• Dissect a typical simulated company's balance sheet to learn how to analyze a company's asset structure. | 解剖典型模拟企业的资产负债表,学习通过资产负债表分析企业的资产结构。

* Income Statement | 利润表

• By filling out the income statement for a simulated company, participants learn the methods and steps for calculating profit, understand the income statement's structure, and interpret its meaning. | 学员通过填报模拟企业的利润报表,学习计算利润的方法和步骤、了解利润表的结构、解释利润表的含义。

• Through analyzing the income statement, identify the composition of various revenues, costs, and expenses. | 通过研究利润表,认识各项收入、成本与费用构成。

• Practice determining the operating results of each simulated company to uncover the sources of enterprise profit. | 练习每个模拟公司的经营结果,揭示企业利润的来源。

* Cash Flow Statement | 现金流量表

• Analyze cash usage in simulated operations to understand the importance of cash. | 分析模拟经营中的现金运用,理解现金的重要性。

• Prepare the cash flow statement, familiarize yourself with its structure, recognize its role, interpret the cash flow statement, and learn cash flow management. |制作现金流量表,熟悉现金流量表的结构,认识现金流量表的作用,解读现金流量表,资金链管理。

• Through analyzing the cost of capital, emphasize the management concept that "Cash is King," enhancing managers' risk awareness. | 通过对资金成本的分析,强调"现金为王"的管理概念,提升管理人员风险意识。

II. Leveraging the Information Behind the Numbers | 管理数字背后的信息

• Extract key data from the three major statements to support management decision-making. | 从三大报表中提取对管理者决策的关键数据。

III. Gaining a Holistic Understanding of Business Operations: How Financial Data Aids Operational Decisions | 从整体上了解商业运作, 财务数据帮助经营决策

IV. Course Summary: Developing an Action Plan for Practical Work | 课程总结: 制订在实际工作中的行动计划

Agenda | 日程安排

8

45AM

-

9

00AM

9

00AM

-

9

10AM

10

10AM

-

10

20AM

12

00PM

-

1

00PM

2

20PM

-

2

35PM

4

00PM

-

5

00PM

Trainer | 培训师

Professional Experience | 职业背景:

- Consulting Partner at Suzhou Qihe Accounting Firm | 苏州起禾会计师事务所咨询合伙人

- ChiefTrainer, Yundaocheng Data Services Co., Ltd., Suzhou Industrial Park | 苏州工业园区云道成数据服务公司首席培训师

- Board Member. Suzhou Industrial Park Social Innovation and Development Cent | 苏州工业园区社会创新发展中心理事

- Member,External Mentor Committee,Xi'an Jiaotong-Liverpool University | 西交利物浦大学校外导师委员会委员

Professional Experience | 职业经历:

- Over 30 years of practical experience in industrial economics and corporate management. Held senior managementpositions at Fortune 500 companies including DuPont, Nokia, AkzoNobel, and COsco Group. Served as General Manager ofMetalex Technology (China) before transitioning to the training industry. | 逾30年产业经济与企业管理工作实践,曾于杜邦,诺基亚,阿克苏诺贝尔,中远集团等世界500强公司担任高级管理人员, 加入培训行业前曾任瑞士美泰乐科技公司中国区总经理。

- Proficient in multiple industries and sector development, well-versed in corporate operational practices, and knowledgeable aboutinternationalfinancial systems. | 熟悉多个产业及行业发展,熟悉企业经营实操,熟悉国际金融体系。

- Successfuly co-founded two companies: one now generates over RMB 1 bilion in annual sales, while the other is a potential unicorn in Suzhou. | 本人成功参与创立两家公司,现一家销售超10亿RMB, 一家为苏州潜在独角兽。

Primary teaching courses | 主要讲授课程:

- Strategy Courses: Strategic Thinking, Practical lmplementation of Strategy, Corporate Strategy Development and ExecutionLeadership Courses: Leadership in the VUCA Era, Stakeholder Management, Change ManagementBusiness Acumen, MINI MBA; | 战略课程: 《战略思维》、《战略落地实战》、《企业战略制定与实施》;

- Finance Courses: Advanced Financial Management for Corporate Executives, Financial Management for Non-financialManagers; | 领导力课程:《VUCA时代的领导力》《利益相关者管理》《变革管理》《Business Acumen》《MINI MBA》

- EVA Management System, Tax Arrangements in Capital Operations, Comprehensive Budget Management and Control,Lean Accounting, U.S. FCPATraining; | 财务课程:《企业高级经理财务课程》、《非财务经理的财务管理课程》,《EVA管理体系》,《资本运作中的税务安排》,《全面预算管理与控制》《精益会计》,《美国FCPA培训》

- Entrepreneurship Courses: Angel investment Practice, Equity incentives Explained, PE investment Framework and Terms Startup Valuation, Pre-lPO Financial and Internal Control Preparation, Entrepreneur Marketing. | 创业课程:《天使投资实操课程》《股权激励那些事儿》《PE投资框架与条款》《初创企业估值》《企业上市前财务与内控准备》《Entrepreneur Marketing》。

Selected clients Served with Consulting and Training | 曾提供过咨询和培训服务的企业(部分):

- Volkswagen Group (Germany, schaeffler Group (Germany, Dassault Group (France), china State shipbuilding Corporation, shanghai saiheng lmport& Export Co., Qingdao fukang Electromechanical Co., German Machine Tool Builders'Association, European Chamber of Commerce in Suzhou | 德国大众集团,德国舍夫勒公司 ,法国达索公司,中国船舶集团,上海赛衡进出口公司,青岛阜康机电公司,德国机械工具协会,苏州欧洲商会

Registration Notes | 注册须知

- There are only 30 seats for this training. Please register for it at your earliest convenience. | 本次培训仅有30席位,请尽早注册。

- The e-invoice will be sent to you within 7 days after the training. | 电子发票将在培训结束后7天内发送给您。

- This is a full-day event, and lunch will be provided. | 这是一整天的活动,中午会提供午餐。

- Refunds will be given for cancellations received before 24 hours. No refunds will be granted if the cancellation is received within 24 hours before the training. | 活动开始前 24 小时以上取消注册,可获得退款。活动开始前 24 小时内取消的,将不予退款。

- If you have any questions during the registration, please contact | 如您在注册中有任何疑问,请联系:Lya Chen, mobile phone: 180 5104 2137, E-mail: info@dusa-eu.cn

Tickets | 门票

** Lunch is included in the ticket price.

费用里包括午餐。

DUSA Annual Partners

2025 DUSA Oktoberfest® Sponsors